In the first nine months of last year, the earnings per share (EPS) of FBNHoldings Plc, the parent company of First Bank of Nigeria Limited as well as its profit grew by 125 per cent year-on-year (Y/Y).

But there is much more to where the premier bank stands in core banking and its profitability is not a mere accretion of transaction charges but that it has also increased its commitment to financial intermediation. In the three quarters, its interest income, which gives a clue of sustainable profit run, grew by as much as 165 per cent to N1.63 trillion.

And these are not just a random progression, neither are they products of white noise in its corporate journey. It has shown consistency of growth in both top and bottom-line metrics in the last few years, giving an expression to the tagging of its post-2015 crisis era as the ‘decade of miracle’ in the investment market.

For instance, from 2019 to 2023, its most recent audited financial, its EPS has expanded by over fourfold – from 195 kobo to 859 kobo, one of the fastest growing in Nigeria’s capital market. In the same period, it grew its yearly operating profit by over 320 per cent, from a mere N73.8 billion to N310.5 billion.

On the top line, its earnings nearly tripled, growing from N623 billion to N1.6 trillion in five years, during which its total assets jumped by N10.7 trillion to close last year at N16.94 trillion. In the half-decade, according to data obtained from its books, its total shareholder’s equity even grew faster – expanding from N661 billion to N1.75 trillion or 163 per cent.

As a key growth driver, its loans to customers saw a whopping rise of 243 per cent in the period to hit N6.36 trillion as of December 2023. Its facilities, according to information gleaned from its financials are spread across key sectors, including oil and gas, manufacturing, agriculture, agro services, construction, and real estate among others.

Whereas the five-year cycle has demonstrated robust growth, last year’s operations demonstrated even more resilience with the awaited full-year result promising to trump the previous ones. On key profitability indices, last year’s nine months exceeded the 2023 comparative period or full year by wide margins.

For instance, its earnings in the first nine months of 2024 were N2.25 trillion or N655 billion higher than the entire 2023 figure and 134 per cent higher than its comparative period, pointing to an annualised gross of N2.8 trillion. While the interest income showed remarkable growth, its non-interest income was also 82 per cent up from the 2023 three quarters’ N320.5 billion.

The lender’s recent migration to transaction-led banking is paying off with the reinvention of its digital payment system. At the close of last September, First Mobile subscribers had hit 6.9 million while over 23 million had subscribed to a potpourri of online platforms.

With its new 10-year vision, which was articulated in 2023, billed to consolidate these gains, the ‘decade of miracle’ might as well serve as the launch pad of the new FirstBank. But the recent boardroom intrigue and the dispute with General Hydrocarbons Limited (GHL) are a costly distraction the bank cannot afford. Hence, many stakeholders are seeking faster and less confrontational solutions to the crisis.

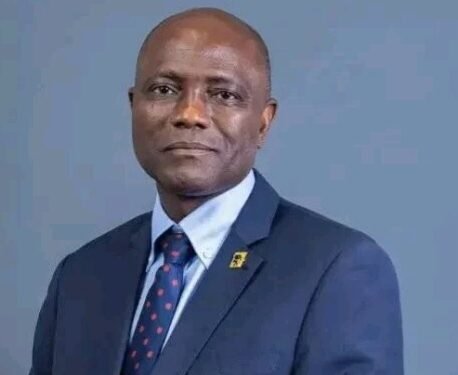

Amidst the conflicts, the Chief Executive of FirstBank Group, Olusegun Alebiosu, described a 10-year vision of the bank as a major stand in its Vision 2033, which would push the Nigerian premier financial institution to top three universal banks in Africa across retail, wholesale and wealth management customer segments.

“Given that the 10-year vision aspiration is still very market-relevant, and I was also an integral part of the process that birthed it, I intend to focus on ensuring its disciplined execution during my tenure as the Chief Executive Officer.

“As the CEO, I have a clear vision for FirstBank Group, and I am confident that with the strong support of the rest of the management team and board, we will deliver a franchise that will continue to be the pride of Nigeria and Africa within the financial services landscape,” the chief executive, who has told the market that his risk management background means nothing short of sustainable growth, said.

At the 12th AGM of FBNHoldings held on 14th November 2024, shareholders approved another N350 billion capital raise action, which the bank said would be executed in a blend of approaches this year. Plus, with the previous N150 billion rights issues, FirstBank is expected to exceed the new N500 billion minimum capital requirements well ahead of the 2026 deadline to keep its international licence.

A major speed slowing the pace of the traditional banks today is the natural advantage that digital-first banks like Opay, MoniePoint and others have been cloud-natives. Sadly, the brick-and-mortar toga poses a legacy constraint for traditional banks. But FirstBank, the first fruit of the conventional banks, has gone ahead with a digital evolution campaign.

Today, the CEO said, over 90 per cent of FirstBank’s customer-induced transactions happen on the digital channels – FirstMobile, FirstOnline, Lit App, *894#, FirstDirect and ATMs, where it has a comparative advantage.

“As the bank implements its cloud strategy, we are focused on building a nimbler, always-on and resilient financial services group that leverages its rich legacy to serve its customers’ current and emerging needs,” Alebiosu believes.

Interestingly, 2025 is the take-off of the bank’s 2025 to 2029 strategic planning cycle. The bank intends to “double down” on its dominant position across all the markets where we operate. Part of the programme is strategic investments to improve customer experience to make it easier for existing and prospective customers to interact and do business on its offline and digital platform, deploying new technologies and ramping up artificial intelligence deployment to scale up digital operations.

But as it turns out, FirstBank and its sister organisations also have a responsibility to urgently put behind the current distractions to continue consolidating the gains of the ‘decade of miracle’.

By Geoff Iyats

NESG Appoints Wole Adeniyi, Mohamad Darwish, and Olusegun Alebiosu as Board Members

The Nigerian Economic Summit Group (NESG) has announced the appointment of three leaders, Mr Wole Adeniyi, Mr Mohamad Darwish, and Mr Olusegun Alebiosu, to its board of directors. These appointments reflect the NESG’s steadfast dedication to promoting visionary leadership and strengthening partnerships with key business leaders and private sector stakeholders. The addition of these accomplished professionals is expected to drive strategic initiatives aimed at transforming and advancing Nigeria’s economic landscape.

Wole Adeniyi is the Chief Executive Officer of Stanbic IBTC Bank Ltd and is responsible for driving the institution’s strategy across her Technology, Digital Transformation, Corporate & Investment Banking arm, and Retail banking arm. Before assuming this role, he was the Deputy Chief Executive Officer of the Bank. Until July 2020, He was Executive Director of personal and business banking retail and commercial banking business of Stanbic IBTC Holdings PLC that covers personal banking, including private banking, business (sole proprietor to SME) and commercial segments. Until November 2018, Wole was Executive Director, Operations responsible for Operations, Group Real Estate Service and Procurement and Business Transformation Program for the Bank.

Before this appointment, he served as Executive Director of Business Support until November 2011. Wole has a wealth of banking experience spanning almost three decades in technology & digital transformation, domestic and international banking operations, program management, and retail banking. He is credited with formulating and deploying strategies to help turn around Stanbic Bank Nigeria’s Operations and Technology. Wole sits on the Nigeria-Interbank Settlement System PLC (NIBBS) board. He holds a first-class degree in Business Administration from the University of Benin and an MBA in Business Administration from the University of Manchester. He is a Fellow of the Institute of Chartered Accountants of Nigeria, an Associate of the Chartered Institute of Taxation and a Certified Information Systems Auditor.

Mohamad Darwish has over 20 years of experience working in the telecommunications sector and is IHS Nigeria’s Chief Executive Officer, overseeing IHS Tower’s largest market. Mohamad Darwish has worked in various finance and technical functions and served as the Business Development Director and Deputy CEO before becoming the CEO of IHS Nigeria. Mohamad is responsible for leading the team committed to growing IHS Nigeria’s operations and further strengthening its position as the leading tower company in Nigeria. He oversees the development of the IHS Nigeria strategic plan and the rollout of new sales strategies and manages key relationships with clients, regulators, ministries and NGOs.

As a member of the IHS Finance and Banking, Risk Management, Ethics, and Compliance committees, Mohamad also focuses on defining IHS Towers’ strategic plans on a group level while ensuring full compliance with international standards and best practices. Mohamad is deeply committed to initiatives and programs that position African countries globally, inspire long-term economic growth, and promote sustainable business behaviour. Mohamad holds a Master of Engineering in Applied Operation Research from Cornell University, a Master of Business Administration with Honours from Rollins College, and a Bachelor of Electrical Engineering from the American University of Beirut.

Olusegun Alebiosu was appointed the Managing Director/Chief Executive Officer of FirstBank of Nigeria Limited in June 2024. In addition to this role, he serves as a Non-Executive Director of FirstBank UK, further solidifying his leadership presence across the group’s international operations. With over 28 years of experience in the Banking and Financial Services industry, Olusegun has demonstrated exceptional expertise and leadership in various roles. Between 2016 and 2024, he served as Executive Director, Chief Risk Officer, and Executive Compliance Officer at FirstBank. His professional experience spans various disciplines, including credit risk management, financial planning and control, trade, corporate and commercial banking, agriculture financing, oil and gas, transportation (aviation and shipping), and project financing.

An accomplished academic, Olusegun is an alumnus of Harvard Business School, where he completed the Advanced Management Program and the Harvard Kennedy School of Government. He holds a bachelor’s degree in industrial relations and Personnel Management and a master’s in international law and diplomacy from the University of Lagos. Additionally, he earned a master’s degree in development studies from the London School of Economics and Political Science. Beyond the boardroom, Olusegun is an avid golfer and adventurer. He is happily married and a proud father, balancing his professional achievements with a fulfilling personal life.

Culled From Proshare News