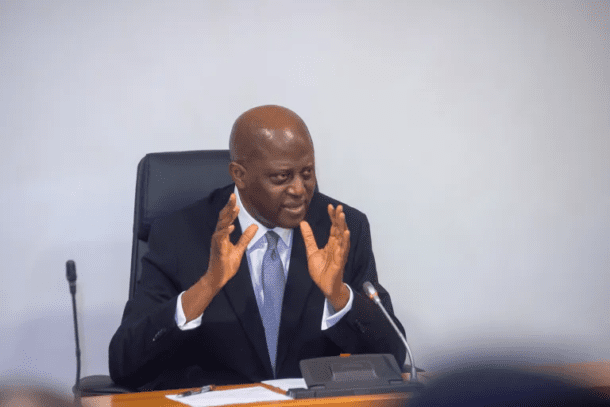

The Central Bank of Nigeria (CBN) is currently embroiled in controversy following allegations that Governor Olayemi Cardoso appointed consultants under questionable terms, granting them significant influence and exorbitant salaries.

Reports indicate that senior staff across the bank’s 29 departments are expressing outrage over the presence and authority of two women—Nkiru Balonwu and Daphne Dafinome—who were allegedly handpicked by Cardoso upon assuming office in September 2023.

Unprecedented Influence and Alleged Abuse of Office

According to insiders, the consultants, dubbed “Cardoso Women,” have assumed roles traditionally reserved for senior bank executives. Despite not being part of the bank’s official organogram, they reportedly issue directives to departmental directors, bypassing even the four deputy governors.

Sources claim the women have permanent offices on the 11th floor, alongside the governor, while the deputy governors operate from the 10th floor. Some bank officials even allege that the consultants boast about their untouchable status within the institution.

Questionable Hiring Process and Compensation

Critics argue that the hiring process for these consultants did not follow due process, violating Nigeria’s Public Procurement Act 2007, which mandates transparency and open competition in government contracts.

Adding to the uproar is the staggering compensation reportedly being paid to the consultants:

- Nkiru Balonwu: ₦50 million monthly—more than 15 directors’ combined salaries.

- Daphne Dafinome: ₦35 million monthly—exceeding the pay of 10 directors.

Dafinome’s Fraud Trial Further Fuels Controversy

In a fresh twist, it has emerged that Daphne Dafinome is facing fraud charges over an alleged ₦100 million property scam. She is set to appear before a Federal High Court in Lagos on March 4, 2025.

Despite this, Governor Cardoso appointed her to the board of NIRSAL, a CBN-owned institution overseeing agricultural credit risk management.

Growing Calls for Accountability

Amidst the unfolding scandal, industry experts and CBN insiders are demanding transparency regarding the consultants’ roles and pay structure.

Many are questioning why the governor has sidelined the bank’s experienced directors, deputy directors, and even its Human Resources Department, which is responsible for staffing decisions.

With pressure mounting, Nigerians await an official response from the CBN leadership as scrutiny intensifies over the alleged misuse of public funds and the unchecked influence of these controversial consultants.