The Monetary Policy Rate (MPR), which calculates interest rates, was increased by the Central Bank of Nigeria (CBN) from 18.5 percent to 18.75%.

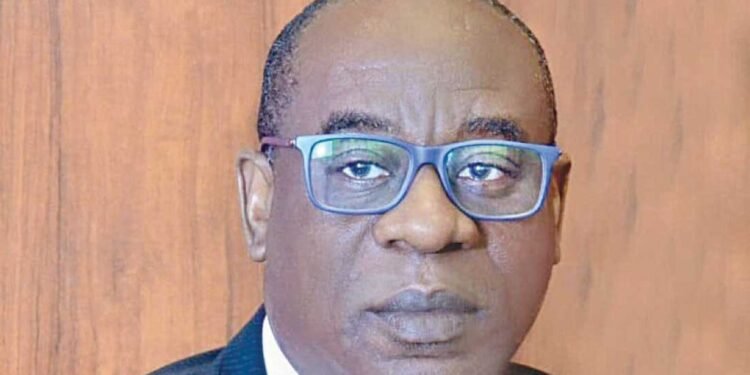

After the CBN’s Monetary Policy Committee (MPC) meeting in Abuja on Tuesday, acting governor Folashodun Shonubi made the announcement.

The monetary committee’s first decision after President Bola Tinubu took office on May 29, 2023, is this one.

It is also the committee’s first decision in about ten years without the controversial Godwin Emefiele, whose tenure as governor of the top bank was suspended on June 9, 2023.

Following the termination of the subsidy on Premium Motor Spirit, often known as petrol, Nigeria’s headline inflation increased to 22.79% in June from the 22.41% reported in May 2023. This was due to increasing food prices and rising transportation costs.

According to the National Bureau of Statistics’ (NBS) most recent data on the Consumer Price Index (CPI), this is what happened. The CPI calculates the rate of change in product and service prices.

Shonubi said that “raising the interest rate has made a lot of difference in moderating the rate of inflation” at a news conference held on Tuesday at the CBN headquarters in Abuja.

The MPR was increased by 25 basis points to 18.75% from 18.5% by the CBN MPC. The committee maintained the Cash Reserve Ratio (CRR) at 32.5% and lowered the asymmetric corridor to +100/-300 from +100/-700.

He said that the volatility around currency exchange rates will soon return to normal.